Global scent trends in beauty, personal care

A consumer's impression of a beauty product comes before applying it to the hair or skin. Next to packaging, a product's scent is one of the most important components a consumer considers when forming a positive or negative opinion. In this INSIDER Q&A, Mintel's Brazil beauty analyst Juliana Martins discusses the latest global scents trends in beauty and personal care, offering tips for how to market fragrances effectively.

A consumer’s impression of a beauty product comes before applying it to the hair or skin. Next to packaging, a product’s scent is one of the most important components a consumer considers when forming a positive or negative opinion. In this INSIDER Q&A, Mintel’s Brazil beauty analyst Juliana Martins discusses the latest global scents trends in beauty and personal care, offering tips for how to market fragrances effectively.

INSIDER: How does a beauty product’s fragrance affect consumer preference/sales?

Martins: A pleasant scent seems to be one of the most important prerequisites for consumers’ search when choosing a beauty product. Many reports showed this. Mintel’s Bodycare – Brazil January 2015 report, for example, shows 47% of users of body care products look for products with a scent they like. Mintel’s Haircare – Brazil, May 2015 report shows 19% of consumers of haircare products are interested in hair fragrances. Men are also interested in fragrances. According to the report Men’s Attitude to BPC – Brazil, July 2015, 56% of men concerned about their appearance look for products that have a pleasant scent.

Mintel’s Fragrance – US, August 2014 report shows that when asked what three factors influenced their most recent fine fragrance purchase, most fine fragrance wearers chose a scent they liked (58%), because smelling good is inherently why consumers buy the category to begin with. Habit and familiarity also play a role in fragrance selection, with 36% of respondents buying their usual scent and 32% purchasing from a brand they are familiar with.

According to Mintel’s Bodycare – US report, for 66% of consumers, a product that has a scent they like is important.

INSIDER: Can you discuss current scent trends across global beauty/personal care markets?

Martins: Consumer interest in multifunctional fragrances and new fragrance formats is high and will certainly help drive growth opportunities within the fragrance industry.

Fragrance for hair

Some users of fragrance are interested in perfume for hair: 17% in France, 19% in Germany, 24% in Italy and 25% in Spain. In addition, 20% of U.S. users are interested and willing to pay more for hair perfume that provides haircare benefits (i.e., improves shine).

Fragrance for clothes

Twenty-seven percent of French female fragrance wearers are interested in fragrances for clothes, while 17% of French and 33% of Italians are interested in and would pay more for detergent that eliminates sweat odors from clothing. In addition, 63% of U.S. fragrance users are interested in fragrances for spraying on clothing/fabric with added fabric care benefits (20% would pay more for this).

Deodorant fragrances

Twenty percent of UK consumers are interested in buying and willing to pay more for deodorants that feature fine fragrance (e.g., well-known perfumes or eau de toilette); 17% are interested in buying and willing to pay more for deodorants with fragrances designed to complement perfumes/ eau de toilette.

Long-lasting moisture to fragrance

Eighty-eight percent of Spanish shower product users are interested in long-lasting moisture (37% would pay more for this), while 84% of Italian users are interested in long-lasting fragrance in shower products (26% would pay more for it).

INSIDER: How big of a role does “natural" play when crafting scented beauty products? Are there certain natural ingredients that are trending worldwide?

Martins: Natural ingredients have sustainable benefits, and consumers are paying more attention nowadays on products’ ingredients and the risks some products’ fabrication can bring to their health and the environment.

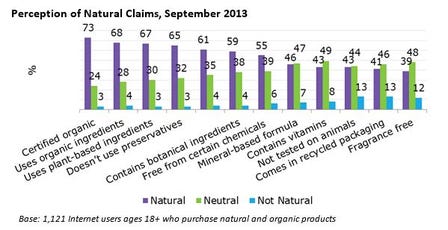

Mintel’s Natural and Organic Personal Care Consumer - US 2013 reports that approximately 45% of respondents agree there are so many brands making natural and organic claims that it’s hard to tell which ones are actually natural. One-third (33%) of respondents think natural and organic personal care products are too expensive.

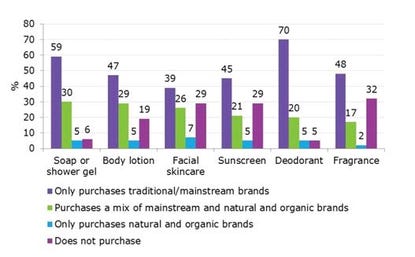

Less than one in five American soap/body wash buyers have purchased products made from all-natural/botanical ingredients. However, 40% say that they feel more confident using BPC (beauty and personal care) products that are made with natural ingredients.

Examples of natural ingredients include traditional beauty oils in Africa, Asia and the Middle East (prickly pear, avocado oil, baobab oil, etc), as well as aloe vera, almond oil, Brazil nut, and fruits from the Amazon region (e.g., pitanga, açaí, cupuaçu, and buriti).

The interest in using natural and organic beauty products will continue to grow as consumers are interested in living greener and healthier lifestyles, with use of natural and organic personal care products viewed as a key component of green living.

INSIDER: Do you have any advice for companies marketing certain scents within beauty products?

Martins: Brands should focus on delivering more value-added benefits (for example, fragrances with skin care benefits), as a way to help curb sales declines. Also, alternative formats, such as rollerballs and solids, can provide consumers with a more portable and lower-cost alternatives to traditional fragrance formats. In-store diagnostic tools to aid consumers in identifying their own product preferences could make the choice easier, while vending and other booths can offer shoppers a unique in-store experience.

Floral, fruity, fantasy, gourmand and fresh & clean are the most common fragrance families across personal care categories. In soap and bath products/body care, floral is the most represented family; while in deodorant, fantasy fragrances are more common.

In 2014, the global fragrance market reached US$28 billion, led by Brazil ($3.1 billion), the US ($3.0 billion), France ($2.7 billion), Russia ($2.6 billion) and the UK ($2.3 billlion). Brazil has experienced strong growth over the last five years. Meanwhile, the second biggest global market, the United States, is declining in value, alongside other mature European markets, where mainstream fragrance brands are struggling to gain consumer interest. Over the next five years, the fragrance market is forecast to decline of CAGR in France (-0.3%), and in the United States (-0.8%).

The strongest growth has been generated by Asian countries, including Indonesia, India, Vietnam and South Korea. Fragrances are rather new in some of these countries, but are experiencing fast penetration in countries like South Korea, where local players are rapidly introducing fragrances across their brand portfolios.

Learn more from Martins as she speaks on “Scent Trends in Personal Care" at the second in-cosmetics Brasil event, taking place September 30 to October 1 in Säo Paulo, Brazil.

About the Author

You May Also Like