The relationship between sleep aids and stress management

Driven by consumer demand for non-chemical solutions to their health needs, companies are pushing hard to develop products that look at alternative approaches to both calming consumers and ensuring a long and quality sleep experience.

October 22, 2018

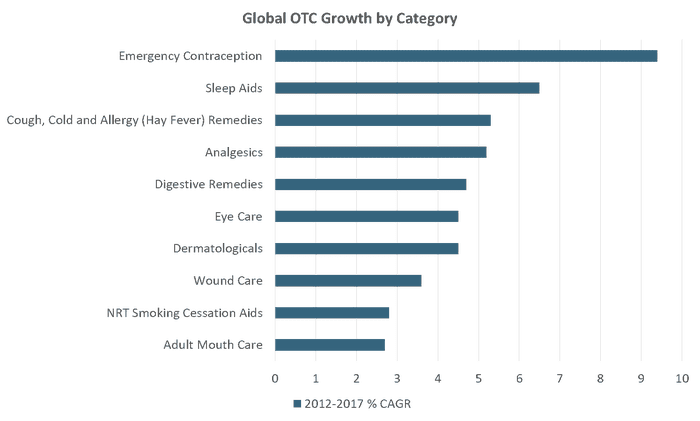

Sleep aids are rapidly growing in popularity across the globe, posting a compound annual growth rate (CAGR) of 6.5 percent between 2012 and 2017 to reach retail sales of US$2.3 billion in 2017, according to market research firm Euromonitor International. Driven by an increasingly stressed and sleepless consumer base, particularly in the developed world, sleep aids are expected to continue growing through 2022.

Stress and sleep management are essentially one in the same when looking at consumer response: lack of sleep leads to increased stress, which results in an increase in reported sleeplessness. As a stressed consumer base turns to over-the-counter (OTC) sleep aids for relief, products positioned to address both conditions will continue to grow in popularity.

Sleep Aids Among Fastest-Growing OTC Categories

Though retail sales of sleep aids amounted to just $2.3 billion in 2017—far below cough, cold and allergy remedies, which is the largest OTC category—sleep aids experienced strong growth over 2012-2017, second to emergency contraception, which posted a CAGR of 9.4 percent over the same period. Looking forward, sales of sleep aids are expected to post a CAGR of 2.6 percent globally through 2022, according to Euromonitor.

Source: Euromonitor International

Sales of sleep aids are heavily affected by demographic and epidemiological factors, particularly in the developed world as consumers increasingly report higher levels of work- and family-related stressors as well as a decline in number of hours slept each night. As stress levels continue to increase, consumers will likely continue to turn to OTC sleep aids for relief.

Increasing Stress Levels

The most common sources for consumers’ increasing stress levels are their jobs, familial obligations and, often, pressure from peers or society to work harder and accomplish more to achieve perceived success. Surveys of consumers’ attitudes toward work/life balance and stress management activities indicate across global markets (though largely excluding the developing world), consumers report being more stressed and under more perceived pressure in 2016 than in previous years, and there is every reason to believe these attitudes will persist and strengthen in the coming years as well.

Since the market for sleep aids is tied so closely to stress management, any discussion of retail sales of products to promote sleep must necessarily include a discussion about the psychological health of the consumer base and their motivations for buying sleep aid products in the first place.

Stress and Sleep Management: A Negative Cycle

Consumers’ decision to turn to OTC products. to get a good night’s sleep is inexorably tied to stress levels. As many organizations, such as the American Psychological Association, have shown time and again, disrupted sleep impedes the body’s ability to process the stressors of daily life in a healthy way, which in turn further disrupts the sleep cycle and creates a negative feedback loop. more difficult to break the longer it persists. As consumers’ lives become busier and more stressful, especially in more industrialized countries like the United States, there has been higher reported levels of stress among the consumer base. This has directly contributed to the increase in sales of stress management products and OTC sleep aids, both pharmaceutical (such as P&G’s ZzzQuil) and herbal (such as Nested Naturals’ LUNA), as consumers try to break the stress/sleep cycle. The overlapping markets for stress and sleep management mean the most successful products are positioned for both conditions.

Demographic Factors Contribute to Sales

Like other categories in the OTC space, sales of sleep aids are also driven by demographic factors like urbanization and the growing population of consumers in later life, defined as being 65 years or older. Greater urbanization leads to stress from overcrowding, pollution and crime, as well as an increase in stresses related to work and family life, all of which contribute to an increased negative effect on consumers’ sleep patterns. Similarly, as consumers grow older, their bodies produce less of the sleep-regulating hormone melatonin, making it harder for later lifers to fall asleep and remain asleep, both of which often cause later lifers to turn to sleep aids for relief. Both the urban and later lifer populations are growing quickly on a global scale at CAGRs of 2.1 percent and 3.3 percent, respectively, over 2012-2017—faster than the world’s population overall, which grew at a CAGR of 1.2 percent. This trend will continue to drive sleep aid sales moving forward.

Stress Impacts Other Health Areas

High levels of stress are incredibly damaging to physical and psychological health, and in addition to the use of sleep aids for stress relief, there are indications from other consumer goods categories that consumers are trying to adapt their purchasing habits to their increasingly busy and stressed lives.

Globally, products that provide quick boosts of energy or are easy to consume on the go are rising in popularity. For example, global volume sales of reduced-sugar energy drinks grew at a CAGR of 12.1 percent from 2012-2017 versus regular energy drinks at 7.7 percent. Consumers are very aware of how their changing lifestyles are impacting their health, and they are increasingly drawn to products that not only provide health benefits and are natural, but that fit into a busy schedule without adding additional stressors.

Innovations in Sleep and Stress Management

Much innovation in the field of stress management and sleep aids comes in two forms—natural products and medical devices.

Tea positioned as a sleep aid is one of the most successful natural products to enter this space, especially in North America, as tea is well-suited to be incorporated into a consumer’s pre-bedtime relaxation schedule. Pillows are another area of innovation that has rapidly positioned itself as providing improved sleep to consumers.

Additionally, with consumers embracing trends in health management that do not include the ingestion of chemicals, the use of sleep-aiding devices is increasing. There are many different kinds of devices to help improve consumers’ ability to both fall asleep and remain asleep as well as improve the quality of the rest they get, including specialized mattresses and white noise machines, among others.

Driven by consumer demand for non-chemical solutions to their health needs, companies are pushing hard to develop products that look at alternative approaches to both calming consumers and ensuring a long and quality sleep experience.

Keena Roberts is senior consumer health analyst at Euromonitor International.

About the Author

You May Also Like