Shake Up Down on the MusclePharm

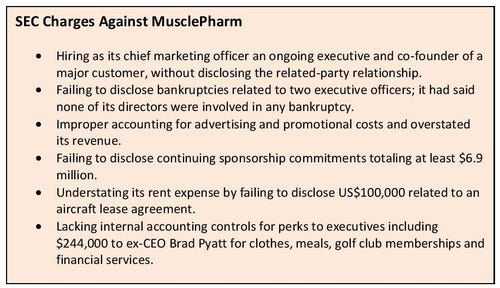

After initiating a restructuring plan in third quarter last year, MusclePharm (OTCQB: MSLP) on Mar. 17 announced a mixed fourth-quarter performance and the resignation of its founder, CEO and board director, Brad Pyatt. His departure followed pressure from investors over the company’s management and a settlement last fall of charges from the Securities and Exchange Commission (SEC) alleging accounting and disclosure violations, including a long list of executive perks involving Pyatt and other execs.

April 27, 2016

After initiating a restructuring plan in third quarter last year, MusclePharm (OTCQB: MSLP) on Mar. 17 announced a mixed fourth-quarter performance and the resignation of its founder, CEO and board director, Brad Pyatt. His departure followed pressure from investors over the company’s management and a settlement last fall of charges from the Securities and Exchange Commission (SEC) alleging accounting and disclosure violations, including a long list of executive perks involving Pyatt and other execs.

It’s been a turbulent year for MusclePharm. While its brand is still strong, the costs of sales and operations far exceed revenues, and has placed the company in a risky financial situation. In its annual report for fiscal year 2015, ended Dec. 31, MusclePharm highlighted this loss discrepancy: “We have not established an ongoing source of revenue sufficient to cover our operating costs, and are dependent on obtaining adequate capital to continue operations, which raises substantial doubt as to our ability to continue as a going concern."

Operating and revenue costs totaled US$216.8 million, but revenues were only $166.9 million for fiscal 2015, resulting in a net loss of $51.9 million. The accumulated loss as of Dec. 31, 2015 was $147.5 million. The company had $7.1 million in cash on hand and $20 million in working capital deficit. “We can give no assurances that any additional capital that we are able to obtain, if any, will be sufficient to meet our needs, or that any such financing will be obtained on acceptable terms," the report stated. “If we are unable to obtain adequate capital, we could be forced to cease operations or substantially curtail our commercial activities."

Among the costs dogging MusclePharm in 4Q and fiscal year 2015 (FY15) were $21.2 million in restructuring costs and $7 million in endorsement payouts related to a series of high-profile endorsement contracts with professional athletes including golfer Tiger Woods and NFL player Johnny Manziel. As part of the restructuring plan, endorsement contracts are being renegotiated, and MusclePharm vowed to move away from such contracts in the future and more toward grassroots marketing. Also, there were and will be costs associated with severance for employees (e.g., directors) who departed as part of the restructuring, as well as for Pyatt.

Despite the tough fiscal year, the fourth quarter results showed a positive direction, according to MusclePharm management. Sales and fill rates showed upward trends, an agreement with Prestige Capital began to address debt and future borrowing issues, and the company continued implementing positive steps in its restructuring plan.

“While MusclePharm continues to face challenges, I am optimistic that the strength of the Company’s brand and the impact of the restructuring plan we are executing will provide positive returns in the near term," said Ryan Drexler, MusclePharm's interim chief executive officer, president and chairman. “We ended the fourth quarter strong, with a 21 percent increase in net revenue quarter-over-quarter to $41 million, and a five-point increase in gross margin to approximately 39.6 percent from 34.5 percent in the third quarter of 2015, excluding the impact of restructuring charges."

Drexler took over Pyatt’s duties as chairman of the MusclePharm board last summer, in a move to separate the CEO and chairman positions. Still, big Musclepharm investors, including Wynnefield Captial, levied harsh criticism of the company’s management and warned it faced bankruptcy or additional regulatory scrutiny if the then-current management structure stayed in place. Wynnefield began selling its stake in MusclePharm in mid-2015. Much of it was picked up by the investment firm Consac.

Drexler was president of Consac when he was brought in as MusclePharm’s new chairman, and the investment firm now owns more than 7 percent in MusclePharm. Prior to Consac, Drexler was a former senior executive and significant shareholder in Country Life Vitamins, which was sold to Kikkoman.

In addition to the personnel change at the top, MusclePharm also brought in a new vice president of operations Jon Heussner, a long-time industry veteran who held senior management positions at Hain Celestial Seasonings Group, ConAgra Foods, Tyson Foods and others. The company also replaced a chunk of its board of directors as part of its restructuring plan.

Along with the executive perks and other disclosure violations exposed by the SEC, MusclePharm has faced legal action in early 2015 over alleged protein spiking and the use of an unapproved ingredient in its Arnold Schwarzenegger Series line of supplements. It was also served a class action lawsuit in December 2015 over amino nitrate ingredients (nitrates bonded to amino acids), which the suit alleged did not work as claimed and has not undergone the required new dietary ingredient (NDI) notification. Previously, ThermoLife International received a rejection letter from FDA regarding its NDI notification for a patented creatine nitrate stating the safety was not proven and continued sale of the ingredient could be considered unlawful due to adulteration.

Also, in addition to charging MusclePharm, Pyatt and other executives, SEC recently filed charges against its former accountant, Florida-based Berman & Co. and its principal Elliott Berman for improper accounting related to MusclePharm, which severed its relationship with Berman in 2012.

You May Also Like