Gauging supplement M&A activity

Valued at $46 billion in 2018, the U.S. supplement industry continues to thrive—a factor that likely influenced a variety of strategic M&A investments in recent years.

It’s no secret the health and nutrition industry is thriving. In its 2019 Supplement Business Report, Nutrition Business Journal (NBJ) valued the 2018 natural & organic product industry at US$219 billion, with 21%—or $46 billion—represented by supplements. And annual events including SupplySide West and Natural Products Expo West are continually increasing in size and scope, setting new records from number of exhibitors and attendees to amount of dedicated exhibit space.

For a closer look at some of the business strategy behind the growth, INSIDER sat down with two financial gurus to discuss merger and acquisition (M&A) activity in the supplement sector the last few years.

Bakley Smith, CFA, is vice president at Green Circle Capital Advisors, a boutique investment bank providing advisory services in raising capital and M&As. The firm’s focus is specific to natural products and tech-enabled services for health and wellness.

Grant Ferrier is co-founder and managing director of Nutrition Capital Network (NCN), an organization that connects investors with high-potential growth companies in the nutrition and health and wellness industry.

INSIDER: What’s going on with M&A activity?

Smith: The basic M&A situation facing the supplement industry is similar to that facing many segments of the broader economy. Ten years of modest but consistent economic expansion has combined with a historically massive amount of liquidity, provided by central banks around the world to create a bullish M&A environment. This means both private equity and companies in the supplement industry have excess cash and access to additional cash that they are using to do deals. This is true both in the U.S. and in other major economies.

The supplement industry has specific tailwinds that are supportive of M&A beyond the general environment. The industry has positive growth drivers and is fairly fragmented. There have been several large deals in the last two years, and there have been smaller deals as well. That said, it is not a “hotbed” of M&A activity with major deals every quarter. We have a view that we are in the “middle innings” and expect more activity in the future as buyers continue to take notice of the positive growth drivers in the space and opportunity to get better returns on lower-priced assets than can be found in adjacent industries like food.

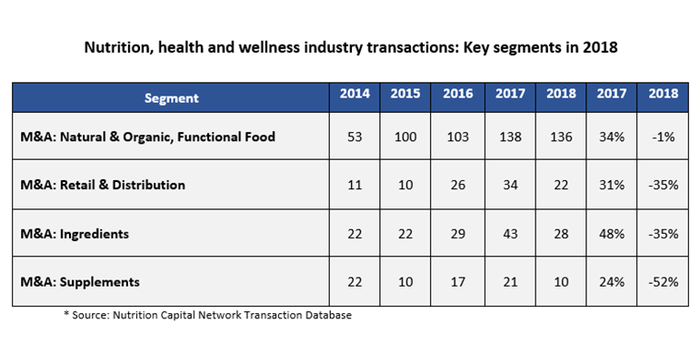

INSIDER: When looking at M&A supplements transactions from 2014 to 2018 (chart below), the drop in 2018 appears significant not only within supplements, but also compared to other health and wellness transactions. Is that a concern?

Ferrier: While the data do indicate, and I do acknowledge that transactions in the supplement industry decreased in 2018, I would view it more as a statistical anomaly than as a major trend. Given that annual numbers of M&A transactions are between 10 and 20 in dietary supplements, fluctuations in percentage are expected given the relatively small numbers. Also, significantly high valuations in 2017 punctuated by Nestlé's acquisition of Atrium likely inflated some perception of value in a number of companies that perhaps would have sold last year but didn't get their price.

INSIDER: How does M&A in the supplement category compare to other sectors?

Smith: The supplement industry does not have the market concentration one would see in nonalcoholic beverages, beer or other concentrated industries. There are fewer major brands, and those brands have less equity than one sees in adjacent consumer categories. This means there are fewer obvious acquirors for growing businesses.

INSIDER: What role are private equity acquisitions playing?

Ferrier: Private equity has a growing influence in the supplement industry, as it has across many sectors of the economy. KKR's acquisition of Nature's Bounty of course was a headliner, and while KKR didn't have an explicit strategy to enter natural health or consumer health as one of the most famous buyout and private equity firms, it has a broad portfolio of industries it is interested in. Recently, we've also seen Nutraceutical International taken private by a private equity firm, HGGC. Swander Pace has made investments in Swanson—a leading mail-order supplement business—and Nutritional Medicinals. North Castle, one of the early investors across the broader nutrition and natural products industry, invested in SmartyPants and sold its Doctor’s Best Supplement brand to a Chinese company back in 2016.

Chinese acquirers have been more active in North America in recent years with the major $700 million acquisition of Iovate—also in 2016, but a significant transaction. And there was the acquisition of Australian supplement company Nature's Care in 2018 by a consortium backed by Chinese government investment.

INSIDER: How do private equity acquisitions compare to strategic ones?

Smith: Low interest rates, a relatively stable U.S. and global economy, and elusive growth have led to a heavy appetite to grow through acquisition. This is true for strategics and private equity-type investors. Generally speaking, strategic acquirors are able to pay a higher multiple to sales or EBITDA [earnings before interest, taxes, depreciation and amortization], as they see synergies available by folding the smaller business into its operations. I must note, some private equity companies act in the same way, as they have big platforms in the VMS [vitamins, minerals and supplements] space and add smaller businesses with an eye toward doing the same thing. Strategic investors are often public companies and as such have the risks associated with answering to public investors and the media. In a traditional view, private equity/venture capital firms can take more risks, in part because they are out of that spotlight.

INSIDER: How did HGGC’s 2017 acquisition of Nutraceutical International Corp. compare to Clorox’s 2018 acquisition of Nutranext?

Smith: We think it is notable that both of these major transactions resulted from rollup strategies which seem to have grown out of some of the industry dynamics we discussed earlier, but were executed along very different timelines. Nutraceutical Corp. was built over the course of decades through a consistent use of a rollup strategy implemented in well over 30 transactions. Management was able to create scale and synergies by benefitting from the fragmented nature of the industry. While Nutranext was also created by rolling together several brands, scale was created in far less time and in far fewer transactions. While the “velocity” was different—and perhaps a result of these trends accelerating in recent years—the implication may be that the ability to create enterprise value through M&A activity in a fragmented industry may still exist in the supplement landscape.

INSIDER: Any comments on notable 2018 M&A supplement activity or other big players?

Ferrier: Some notable transactions from major global players in 2018 included Procter & Gamble acquiring Merck's consumer health brands, which mostly include supplement brands in Europe; and Clorox buying Nutranext, as probably the second-largest available company to acquire after Atrium.

For both of these companies, these were additional plays in the supplement market, as Procter & Gamble acquired the natural channel brand New Chapter previously, and Clorox had acquired Renew Life, a leading probiotic supplement company.

Other big players remaining in the game and keeping the mainstreaming of supplements healthy are RB [Reckitt Benckiser] buying Schiff a few years ago, and Pfizer buying Alacer, as well as ongoing European acquisitions by Bayer. It is no secret that Pfizer was looking to sell its supplement lines, but that transaction didn't come to pass.

INSIDER: How is 2019 looking so far?

Ferrier: 2019 hasn't quite taken off in terms of numbers of transactions in supplements, but there are some notable acquisitions with Unilever buying OLLY, and a $25 million investment in Ritual, and a few cannabis and CBD companies using their newfound capital to buy supplement brands in United States.

An important trend to note here is that Unilever buying in to supplements—in this case, mostly gummies—added to Nestlé's buying into Atrium, which was mostly pills, is an indicator that the world's biggest packaged food and packaged product companies and consumer goods companies are making a long-term bet on supplements. And notable is that executives from both companies told me as recently as two or three years ago that they would never buy into the pill business.

About the Author

You May Also Like