The Economics of Channel Strategy for Food Ingredients

The functional food market is ever-changing, and global competition, emerging trends, demand uncertainty and increasing costs are affecting businesses more than ever. The right channel strategy can help eliminate noise from small customers, reduce complexity costs and thus improve profitability.

August 18, 2015

The functional food market is ever-changing. Global competition, emerging trends, demand uncertainty and increasing costs are affecting business more than ever. During these times, there is an even greater need to focus on profitability. This requires innovation, marketing and execution. To focus on these key drivers, companies must eliminate complexity and allocate resources to meet key-customer needs. The right channel strategy can help eliminate noise from small customers, reduce complexity costs and thus improve profitability.

Segmentation

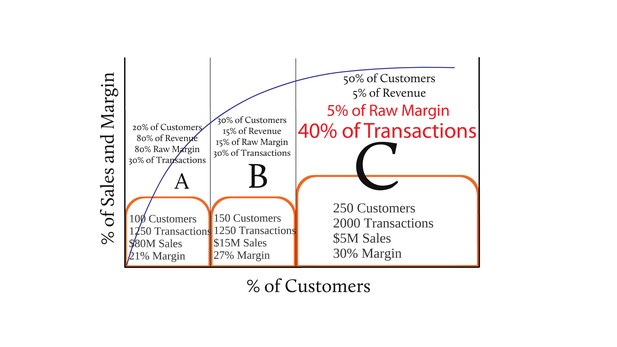

Before examining the economics of the most common channel options, it is important to understand the small customer segment by exploring a typical example of a food ingredient. The “A" customer segment typically represents the top 20 percent of customers and 80 percent of the total sales. Meanwhile, the “B" customer segment is the next 40 percent of customers and 15 percent of sales. Finally, the small or C customer segment typically represents the last 50 percent of customers and 5 percent of sales.

Transaction Costs

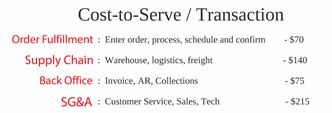

A typical food ingredient product line has 500 customers, US$100 million in revenue, 25 percent margin and 4,500 transactions. The “C" customer segment typically has a higher margin, but it doesn’t always tell the whole story. To calculate the actual profit, the variable costs, or “cost-to-serve," must be taken into consideration and is typically estimated at US$500 per transaction.

Channel Options

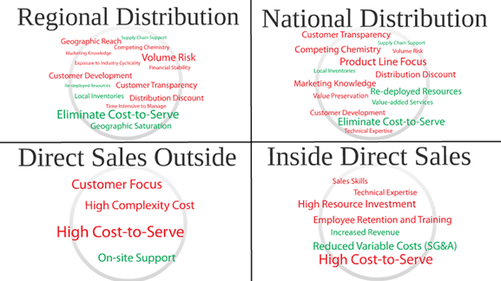

Consider the advantages and disadvantages of the common options to serve small customers. The four most common channel options are regional distribution, national distribution, direct inside sales and direct outside sales.

Direct Outside Sales

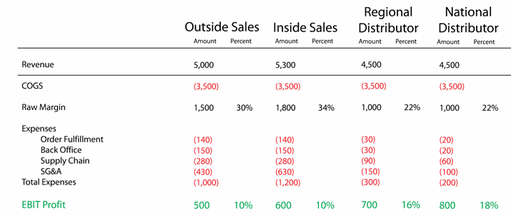

Using a direct outside sales channel leads to a 10 percent profit for the “C” customer segment; 10 percent is still not bad, and this segment is profitable. But if a customer places an order for $2,000, then the company is losing money. About one out of three small customers will place an order for less than $2,000. However, this channel strategy has profitability potential with aggressive business rules, such as higher minimum order quantities, tier pricing discipline, made to order SKUs, lengthened lead times, etc., in order to reduce costs.

Direct Inside Sales

Using a direct inside sales approach actually causes expenses to go up. The order fulfillment, supply chain and back office costs still remain. And in many instances, the SG&A savings is offset by the additional expenses related to process development, technology and employee training and retention. This option has higher profit potential assuming companies:

Invest in people, provide leadership and create a career path

Implement technology to support business process and improve productivity

Implement business rules to further reduce variable costs

Improve all account raw margins above 20 percent

Regional distribution

In this option, the expenses have dramatically reduced, but there are other inherent costs. Highly complex relationships with many regional distributors require a large number of resources to provide direction, create transparency and manage relationship. Costs will increase significantly as this will inevitably lead to a duplication of efforts and resources.

National Distribution

This option has very high profitability potential assuming:

The distributor is externally focused to meet key supplier and customer needs

There is a partnership that encourages joint strategy efforts and information exchange

There is an exclusive relationship that will drive product focus and market development

The distributor reduces complexity to allow you to innovate, cut costs and redeploy resources

So, which channel strategy will return the highest profitability for small accounts? It depends. Choose the option that best meets your needs. Globally, it is estimated that US$60 billion of specialty food ingredients are used annually with a relatively small percentage that is sold through distribution today. The trend indicates that distribution sales will increase to 18 percent within five years. Choosing the right distribution strategy is critical to optimally serve customers and have the highest returns.

Mark Friedl is business director at Chempoint.

You May Also Like